Prepare, protect and provide with our newest IUL product

Virtus Protection IUL – the latest addition to our indexed universal life (IUL) insurance portfolio – offers protection – forward coverage with accumulation potential to help your clients lock in their legacies.

With Virtus Protection IUL, they can prepare for the future, protect their financial well-being and, perhaps most importantly, provide for their loved ones.

NEW! Virtus Protection IUL

Virtus Protection IUL boasts strong death benefit protection along with the potential for account value growth. The cash accumulation component can help the policy owner keep pace with coverage costs over time, especially if they reach an advanced age.

Additional resources for Virtus Protection IUL

Find our IUL products on these platforms

AuguStar Life’s IUL products are now available through iPipeline, the end-to-end platform thousands of firms rely upon to run their practice and process business quickly.

Advanced Planning Strategies Using Protection IUL

Fluidless underwriting accelerates lift-off

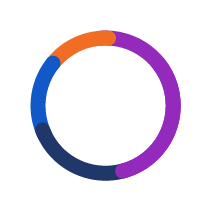

Leveraging in-house tools, we can deliver an underwriting process that’s simpler — and often faster — for you and your clients. Best of all, it provides the results you want with fewer paramedic exams and the same rate class distribution as our fully underwritten policies.

Issued without exam and attending physician statement

79% Issued without

Paramedic / APS

Rate Classes

47% Super preferred

22% Preferred

18% Standard or other

13% Select

Time of Issue

48% Issued in 5 days

or less

Financial strength backed by institutional partners

Constellation Insurance founding investors and equal partners, Caisse de dépôt et placement du Québec (CDPQ) and Ontario Teachers’ Pension Plan Board (Ontario Teachers’), are two of the largest long-term institutional investors in North America.

Together, they manage a total of more than CA$681 billion in net assets, including more than CA$138 billion in private capital investments (as of Dec. 31, 2023).

Cosmic Ratings

We consistently earn high marks for financial security and claims paying ability from independent rating analysts.

A.M. Best

Financial strength: A

Outlook: Stable

Fitch

Financial strength: A-

Outlook: Positive

Moody’s

Financial strength: Baa1

Outlook: Stable

A.M. Best Company: “A,” its third-highest ranking out of 16 categories. Fitch: “A-,“ its seventh-highest ranking on a 21-part scale. Moody’s: “Baa1,” its eighth-highest ranking on a 21-part scale. All ratings information is according to reports published on: ambest.com/ratings, fitchratings.com and moodys.com/insurance. Ratings are for AuguStarSM Life Insurance Company, AuguStarSM Life Assurance Corporation and National Security Life and Annuity Company and are accurate as of 5/10/2024.

Let's connect

We look forward to seeing how we can support your sales journey with AuguStar Life!

* Required field